Disclosure based on TCFD recommendations

The Task Force on Climate-related Financial Disclosures, established by the Financial Stability Board (FSB), requires companies to disclose climate change-related information for the company from an investor perspective, including the climate-related risks and opportunities and the clarification of governance, etc. Daiseki announced its support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD*1) in October 2020 and began assessing the financial impact of climate-related risks and opportunities on the management of the company (scenario analysis*2). Going forward, we will leverage the knowledge we have acquired to date to enhance our scenario analysis and examine countermeasures while engaging in information disclosure under the TCFD framework.

Governance

Board of Directors oversight of climate-related risks and opportunities

Assessment and management of climate-related risks and opportunities by the Sustainability Headquarters

Daiseki's Sustainability Headquarters consists of the President and Representative Director, the executive officers and the Group companies. It identifies risks and opportunities related to environmental conservation and climate change issues, including the results of climate change scenario analysis, and reports to the Board of Directors on the progress of measures to address major risks and opportunities. It also provides information to support decision-making on climate change-related issues by the Board of Directors.

Board oversight of climate-related risks and opportunities

Daiseki's Board of Directors receives the reports on the items deliberated at the Sustainability Headquarters on the risks and opportunities related to environmental conservation and climate change issues and on the progress of measures to address major risks and opportunities, and instructs the Sustainability Headquarters to take necessary actions.

Strategy

Climate change scenario analysis

Daiseki conducts risk management such as scenario analysis based on the TCFD recommendations, etc. at the Sustainability Headquarters. The Headquarters of Planning and Management serves as the secretariat and conducts scenario analysis to identify climate-related risks and opportunities. The risks and opportunities identified are approved by the Sustainability Headquarters and then reported to the Board of Directors.

Scenario analysis time frames and target businesses

When conducting scenario analysis, Daiseki set short-, medium-, and long-term timelines, and included all of Daiseki's business activities and their upstream and downstream impacts on the value chain.

Time axis

Short-term: Up to 2029, including mid-term management plan.

Medium-term: 2030 to 2049

Long-term: 2050 onward

Climate-related key issues

・

4.0°C scenario: Insufficient measures are taken and greenhouse gas emissions increase, resulting in a 4.0°C temperature increase since the Industrial Revolution by 2100.

The policies for decarbonization are unclear and the regulations on fossil fuel use, such as carbon pricing, are not strengthened. Although companies become more aware of the need to decarbonize to a certain extent, companies do not choose low-carbon products if it means accepting increased costs. In this case, energy costs remain the same. As the use of fossil fuels is not decreasing, and demand for recycled fuels is expected to remain at the same level as before, Daiseki will expand its recycling business for recycled fuels. In addition, as weather disasters are expected to become more severe in the medium to long term, Daiseki will implement disaster prevention measures to prepare for the risk of the company itself being hit by a disaster.

| Possible Situation | Impact Assessment | Response | |

|---|---|---|---|

|

4.0℃ Scenario (Little to no intervention) |

Lack of clarity on greenhouse gas emissions regulations | No change in energy costs | Remains at current level |

| Businesses’ emissions reduction efforts have increased somewhat | Opportunities Somewhat increased demand for Daiseki’s low-emissions industrial waste treatment services | Expanding our industrial waste treatment business operations | |

| Opportunities Somewhat increased demand for recycled fuels | Expanding our recycling operations in the recycled fuels category | ||

| Increased severity of typhoons, torrential rain, and other natural disasters | Risks Disasters force Daiseki and/or its customers to cease operations | Disaster prevention measures and securing our supply chain | |

| Rising sea levels and other changes in the marine environment | Risks Flooding forces Daiseki and/or its customers to cease operations | Implementing measures during times of increased flood risk |

・

1.5°C scenario: Strict climate change policies are introduced, and temperature rise by 2100 is within 1.5°C.

The introduction of greenhouse gas emission regulations such as a carbon pricing system and carbon taxation increase the energy costs, so renewable energy-derived electricity (renewable electricity) and vehicles and treatment facilities with low emissions are introduced in response. In addition, the amount of fossil fuels used declines and demand for recycled fuels also declines, so sales are expected to decline. On the other hand, demand for low-emission industrial waste treatment services and raw materials increases. In anticipation of this paradigm shift, Daiseki shifts its center of gravity to material recycling. Material recycling is the recycling of waste into products that as raw materials have functions similar to those of the original products. There is none of the incineration or landfill associated with disposal, and no natural resources are consumed, so it can contribute to the realization of decarbonization and resource circulation.

| Possible Situation | Impact Assessment | Response | |

|---|---|---|---|

| 1.5℃ Scenario (controls applied) |

Greenhouse gas emissions regulations are strengthened (carbon pricing systems and carbon taxation are adopted) | Risks Increased energy costs | Adopting use of power by renewable energies and low-emissions equipment |

| Advances in businesses’ emissions reduction efforts |

Risks Reduced fossil fuel usage ⇒Reduced sales of recycled fuels |

Shifting operations from recycled fuels to material recycling | |

| Opportunities Increased demand for Daiseki’s low-emissions industrial waste treatment services | Proactively expanding our industrial waste treatment service operations | ||

| Opportunities Increased demand for recycled resources with low emissions | Shifting operations from recycled fuels to material recycling | ||

| No change in likelihood of typhoons, torrential rain, and other natural disasters | No change in risk of disasters forcing Daiseki and/or its customers to cease operations | Remains at current level | |

| No change in the marine environment such as rise in sea levels | No change in risk of flooding forcing Daiseki and/or its customers to cease operations | Remains at current level |

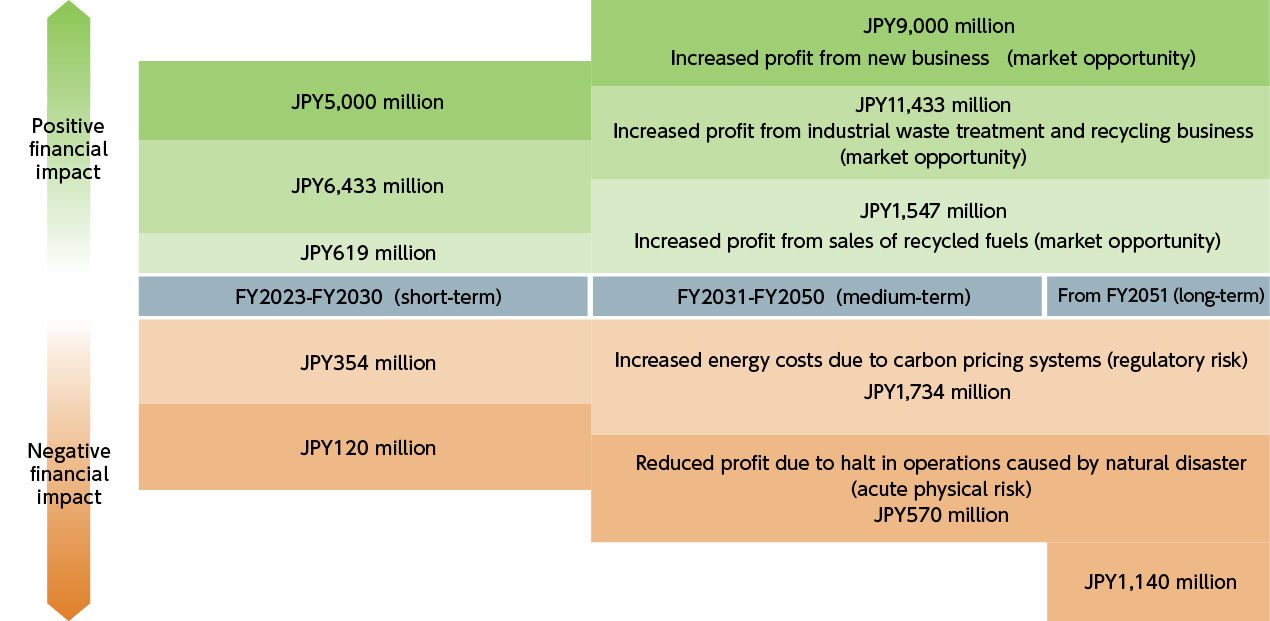

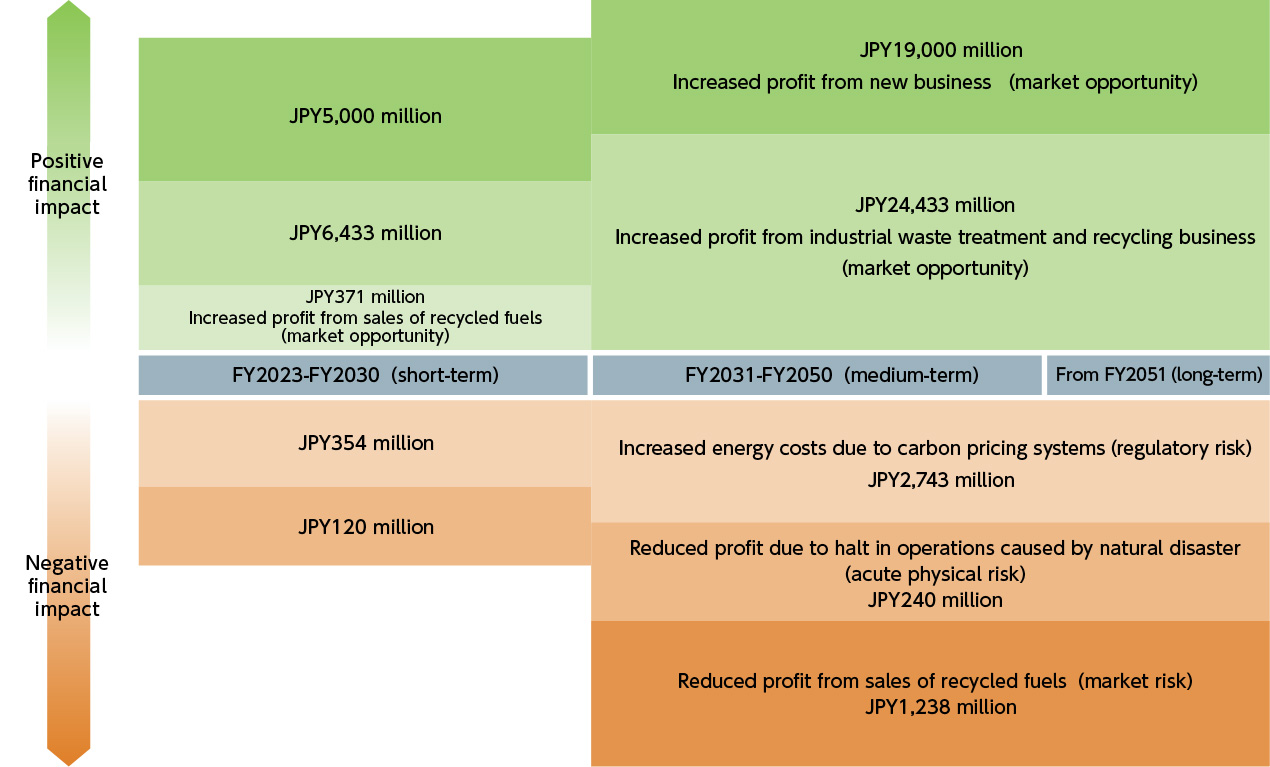

Analysis of the financial impact of climate change risks and opportunities on business activities

The results of analysis of the financial impact of climate change risks and opportunities on Daiseki are as follows.

Financial impacts and response costs under the 4.0°C scenario

Financial impact

Response cost

| Type | Climate change risks and opportunities | Short-term | Medium-term | Long-term |

|---|---|---|---|---|

| Physical risks | Decrease in profits due to operation shutdowns caused by natural disasters | 19 million yen | 140 million yen | 280 million yen |

| Regulatory risks | Increased energy costs due to carbon pricing system | 354 million yen | 1,734 million yen | 1,734 million yen |

| Market opportunities | Increase in profits from sales of recycled fuels | 1,071 million yen | 1,338 million yen | 1,338 million yen |

| Increase in profits in industrial waste treatment and recycling business | 1,071 million yen | 1,338 million yen | 1,338 million yen | |

| Increase in profit from new business | 750 million yen | 1,500 million yen | 1,500 million yen |

Financial impacts and response costs under the 1.5°C scenario

Financial impact

Response cost

| Type | Climate change risks and opportunities | Short-term | Medium-term | Long-term |

|---|---|---|---|---|

| Physical risks | Decrease in profits due to operation shutdowns caused by natural disasters | 19 million yen | 140 million yen | 280 million yen |

| Regulatory risks | Increased energy costs due to carbon pricing system | 354 million yen | 2,743 million yen | 2,743 million yen |

| Market risks | Decrease in profits from sales of recycled fuels | 750 million yen | 750 million yen | |

| Market opportunities | Increase in profits from sales of recycled fuels | 1,071 million yen | 107 million yen | 107 million yen |

| Increase in profits in industrial waste treatment and recycling business | 1,071 million yen | 2,034 million yen | 2,034 million yen | |

| Increase in profit from new business | 750 million yen | 1,500 million yen | 1,500 million yen |

Risk management

Process for identifying and assessing climate-related risks

Daiseki identifies a wide range of issues related to its business activities, and repeats internal and external interviews and dialogues to dig deeper into those issues. The results of TCFD scenario analysis and the climate-related risk and opportunity analysis based on ISO 14001 are also taken into consideration, and then after the materiality is formulated by the Sustainability Headquarters, it is determined after approval of the Board of Directors. For one of our material issues, "Making the best use of limited resources," we have developed KPIs and targets for climate-related risks and opportunities.

Materiality identification process

Process for managing climate-related risks

At Daiseki, the Sustainability Headquarters identifies and assesses the climate-related risks and opportunities. These are then decided by the Board of Directors based on the results of the assessment by the Sustainability Headquarters, and the Board of Directors instructs the Sustainability Headquarters to take the necessary actions. The Sustainability Headquarters oversees the management of climate change risks and opportunities based on that instruction, and asks the Group companies and Works to take action. The Group companies and Works implement action plan PDCA (setting, actions, evaluation, and review) based on ISO 14001 and other management systems, and report the results to the Sustainability Headquarters.

Integration of the processes for identifying, assessing, and managing climate-related risks into the risk management system for the entire company

Daiseki has established a company-wide risk management system to ensure that the operations of the Group can be operated smoothly, by preparing management structures to prevent the occurrence of possible risks, and responding to the risks that have occurred, or may have an impact. The climate change risks have also been integrated into the company-wide risk management.

Indicators and targets

The KPI targets and performance of Daiseki regarding climate change risks and opportunities

For the achievement of the issue of "Making the best use of limited resources," which is one of the material issues for Daiseki, we have set reducing greenhouse gas emissions and increasing material recycling as targets and indicators.

| KPI | Target value and target fiscal year | FY2025 results |

|---|---|---|

| Scope 1 + 2 emissions | 34% reduction (FY2028) | |

| Scope 3 emissions | 20% reduction (FY2028) | |

| Avoided emissions | 785,000 t-CO2 or more (FY2028) | |

| Volume of material recycling shipped | 258,300 tons or more (FY2031) |